Why the Top 10% of the Wealth-Holders Pay Little or No Taxes and How they Control the 90% of Us Who Do

The “working class” are busy arguing with each other about about anything that seemingly threatens their little piece of the pie -- while ignoring the underlying issue -- class warfare.

Chaos often plays a significant role in obfuscating any efforts directed at addressing the root cause of a problem — because chaos has a tendency to take the observer’s eye off of the real root cause of the issue. In other words, we too easily get caught up in fighting off the symptoms and ignoring the disease.

Within our American political and socioeconomic sphere at the moment, the electorate mindset places higher priority on issues such as race relations and illegal immigration, among a number of other factors. These concerns, while not minor in any sense, can be seen as chaotic “noise makers” to hide the real problem, which I will argue below, is class warfare.

Throughout history, astute leaders have realized (or, minimally, considered) that, as long as the “working class” are arguing and fighting with each other about things like racism, immigration, and equality, or about anything else that seemingly threatens their little piece of the pie, there is very little probability that their focus will turn to the underlying issue — and the underlying issue is class warfare. In today’s America, the holders of power seem intent on keeping those kinds of chaotic, ancillary issues directly in front of us, on a daily basis. Their goal can be stated in simple terms: "don't give the working class (90% of us) the opportunity to focus on us (the ultra-rich or the 10%ers)." Americans are famously reluctant to adopt the language of class warfare, or even to acknowledge its existence. And this ambivalence, or failure of recognition, allows and enables class warfare.

The Balance Sheet Issue

In the United States of America today, the top 10% of the population controls nearly 70% of the wealth (68% in 2022). That means that the amalgamated group of 90% of Americans represents only 34% of the nation's wealth! (think about that for a minute).

Just as important, if you look at the liabilities (debt) side, this problem becomes even more poignant. The top 10% of Americans are responsible for only 24% of the nation’s liabilities (although they control some 70% of the wealth). The remaining 90% of us -- the less affluent -- are responsible for 76% of the total liabilities (think house/rental payments, car payments, educational expenses, taxes, maintenance, etc.). So, in effect, less disposable income and higher debt levels are an affliction of the 90% of us who are considered the working class!

The Impact on Social Security

This unbalance presents some enormous issues. Consider, for example, the impact this has on Social Security. Despite the fact that the top 10% control 70% of the wealth, the cap on the Social Security payroll tax is currently set to $160,200. Most of the ultra-rich pay only the smallest of micro-fractions of their total incomes into Social Security (more about why, below). In the United States, the social security withholding tax cap benefiting the ultra-rich results in a situation wherein the country is effectively relying on the combined tax revenues that are collected from the ordinary incomes of a group of Americans who only hold 32% of the wealth -- that small fraction which is attributed to the combined 90% of us -- to fund the largest part of the (non-interest) Social Security Fund's income needs. The portion of the population attributed to nearly 68% of the nation's wealth does not contribute toward financing Social Security in any substantial way (see why, below)!

And yet, those of us who are contributing to social security are, by far, much more economically burdened than the ultra-rich, since we hold 76% of the nation's liabilities! Unless, we remove the cap on the social security tax, solvency of the Social Security Trust Fund will remain a burning issue.

The Impact on Tax Revenues and the Economy

Our economy, in general, struggles with an obvious bias that disproportionately benefits the top 10%'ers. This happens because that group earns, by far, the most passive income (unearned income).

Another good example of this is how it plays out in the real estate market where, for example, the two wealth factions we are considering (the 90% of us and the top 10%) can easily be grouped into two main economic classes:

- "Rentiers," who use accumulated money to make money by placing their wealth in assets which produce passive income; and

- "Debtors", who use their labor or skills working for paychecks, including self-employed business operators, to fund their living expenses until retirement.

Debtors constitute a wide, sturdy base on which rentiers build their wealth. While debtors can earn anything from minimum wage to a six-figure salary — they remain “Debtors” as long as they have to pay their dues to the “Rentiers”. The rentiers hold the assets that debtors need to function and maintain their quality of life.

For the top 10%, the capital gains tax is capped at 20% — allowing allowing them to systematically retain significant levels of minimally-taxed excess income flowing from the cash flows arising from the ever-present tenant demand. Rentiers simply use their wealth to provide their own housing on a debt-free basis and don't have to rely on monthly wages for rent or mortgage payments.

It’s not unusual to think of our uniquely American economy as one in which the 10% are finding ways to get the 90% increasingly into debt. And as that happens they are siphoning off (as interest payments and other financial charges) whatever labor or business earns. Mortgaged property owners and renters feed their earnings into expensive homes and rental payments (to the financial end benefit of the rentier class).

Chamber of Commerce, a product research company for real estate agents and entrepreneurs, used numbers from the U.S. Census Bureau to analyze monthly housing costs and median household income in the 170 most populated U.S. cities. The company found that 27.4% of all homeowners are “cost-burdened” in its study. So more than one-quarter of homeowners in the United States are “house poor,” spending more than 30% of their income on housing costs, according to a new study.

With all their financial attention focused on myriad debt payments, including mortgages, student loans and consumer credit, as well as inflation and the rising cost of food staples, residents have little surplus cash for savings or to expend on goods and services to help them achieve a more enhanced standard of living (or invest in income-generating real estate assets, for that matter). Since “debtors” typically do not have sufficient disposable income, it is more difficult for them to participate in the larger economy and real estate sales, in particular.

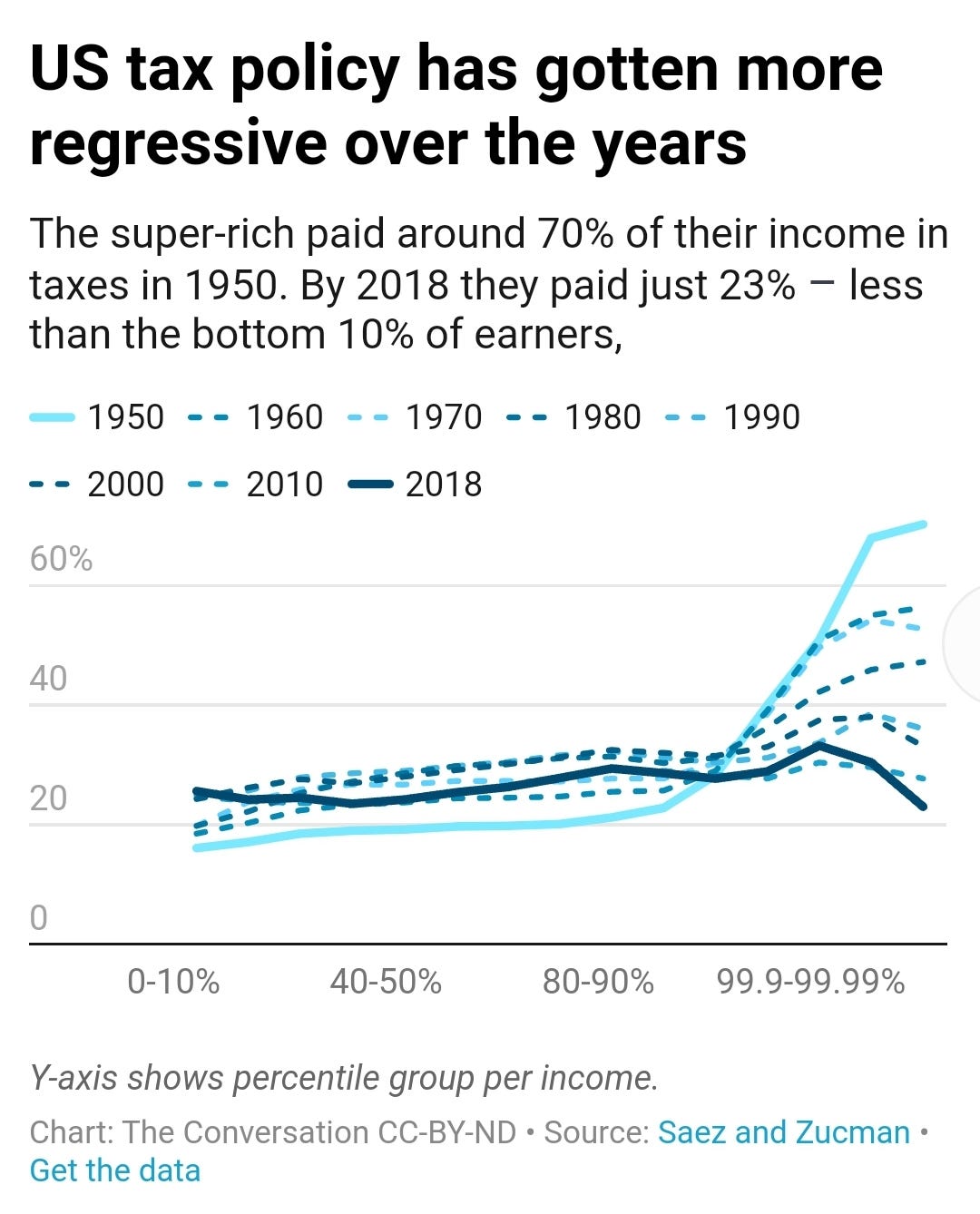

One well known approach to fighting this problem is a progressive tax structure in which the rich are taxed proportionally more than the poor, which has the effect of reducing the amount of income inequality in society. However, our tax structure is actually rather regressive for the very high income people (see image below, under “The Big Picture”.

Moreover, while a more progressive tax structure seems simple and logical enough on the surface, there are a number of ways that the top 10% of the income earners in this country can legally use the tax code to minimize or even completely avoid taxes! They employ highly effective strategies that, unfortunately, are largely unavailable to most lower-income taxpayers. The ultra-rich do not typically receive their wealth in the form of weekly paychecks or regular salaries. Billionaires have the ability to tap into their wealth by borrowing against it. And borrowing isn’t taxable as income. They don’t need to pay themselves a taxable income.

Even when the top 10%ers show income on their tax return, they tend to pay relatively low income tax rates. Multi-millionaires and billionaires often store most of their wealth in assets like stocks, real estate, and operating businesses. This type of wealth allows investors to avoid paying capital gains taxes, because it’s not considered income until it’s sold or “realized”. This is related to the type of income they have: for these ultra-rich investors, income means gains from long-term investments, such as from stock sales, which are taxed at a lower rate. Finding creative ways under the existing tax code to transform more highly taxed income into the lower taxed income generates enormous tax savings for the ultra-rich. Strategies that are employed to achieve this include (among some others) self-directed IRA LLCs and blind trusts.

As an example, tech mogul Peter Thiel amassed a $5 billion Roth IRA, a type of account that shields income from taxes and is intended to help low- and middle-class savers prepare for retirement.

Another strategy that the ultra-wealthy frequently employ what is referred to as the Buy Borrow Die Tax Strategy. This ingenious tax planning strategy involves buying assets, typically investment properties or other real estate, borrowing against these assets at less than their appreciation rate. The assets are then eventually passed down to heirs, often with little or no capital gains tax liability. The Buy Borrow Die Tax strategy provides the ultra-rich a way to reduce taxable income through depreciation and it allows for cash extraction without needing to sell the asset. Subsequent heirs, to whom the asset is passed can then sell their inherited assets tax-free due to the step-up in basis rules. And this is also why, in my opinion, it is no longer really possible or advisable to discern between wealth and income for this wealthy, high-income fraction — because, at least for this class of people, wealth and income are essentially one and the same.

Have you ever wondered why so many ultra-rich people own sports franchises? What they do is actually quite interesting. It’s not really important whether the team is actually profitable and/or growing in value. In either case, the franchise can still be used as a tax write-off. Team owners have even been known to effectively deduct a given player’s contract not once, but twice (depreciation). They’re allowed to take deductions comparable to those for factory equipment that loses value as it ages, even as teams almost inevitably gain in value!

All of these things are perfectly legal within the current tax code, which allows not only individuals, but some of America's largest companies, to take advantage of tax breaks and deductions to minimize and often eliminate their corporate income tax liabilities

Corporate America is also quite adept at employing these kinds of tax avoidance strategies. Some of the nation’s largest companies adopt lucrative (and perfectly legal) tax avoidance strategies to pay effectively zero taxes. These include accelerated depreciation, the offshoring of profits, generous deductions for appreciated employee stock options, and tax credits.

In the real estate or oil and gas industries, for example, enormous and plentiful tax breaks allow the 10% ers an opportunity to potentially erase their income entirely even as they grow richer.

In 2007, Jeff Bezos was a mere a multi-billionaire and is now the world’s richest man. In 2007, Jeff Bezos did not pay a penny in federal income taxes. It happened again in 2011. Tesla founder Elon Musk is the second-richest person in the world. In 2018 he also paid no federal income taxes. Michael Bloomberg managed to do the same in recent years. Billionaire investor Carl Icahn did it twice and George Soros paid no federal income tax three years in a row.

These are just a few of many such examples of how the rich, ruling class plays out of a different playbook to avoid paying taxes and to keep the 90% of us fighting with each other over issues that are intended to obfuscate the real issue: class warfare.

The Big Picture

It becomes rather clear that 90% of us are being controlled by a ruling class (10%) of the ultra-rich. And coming out of this situation will be no simple task, because it involves tactics that are largely unsupported by the ruling class and their armies of lobbyists. Unless we revise and simplify the tax code by removing tax caps on higher income earners, closing loopholes, and making the tax code more progressive for higher income people, as it was in the 1950's when this nation was incredibly prosperous (see image below), the ultra-rich, ruling class will keep it's collective grip on those of us regular Americans.

America seems to be inching dangerously close to the extreme level of class struggle that Marx and Engels anticipated some 200 years ago. And it seems as if this is a result of economic constraints, not racial tension, nor any other attendant issue. America’s urban centers have become rife with violence, property destruction, homelessness, and huge spikes in crime. These are some the chaos elements that I refer to above — those that keep everyone’s eye off the real issue.

The lower classes are merely fighting with each other for piece of the pie that continually shrinks in size and as they are increasingly economically and politically marginalized. This reaction benefits the ultra-rich since the rest of us are wading through the chaos:

- Continually difficult budget constraints;

- Racial fires that are fueled, in effect, by the rich;

- Taxation that has now become largely regressive for the ultra-rich;

- The extraordinary and unbalanced burden of supporting social programs like Medicare/Medicaid and SNAP;

- The effects of illegal immigration; and

- A shrinking level of disposable income.

All of these things represent vectors of control that work to the benefit of the ultra-rich. It doesn't really make a difference whether the conflicts are racial, or political or culture-based. In almost every case, fighting through these kinds of "chaos" issues keeps the 90% of us from concentrating on the real issue -- demanding and legislating more equitable wealth sharing.

When the lower classes feel financial pressure, their natural reaction is to fight over the small piece of the pie that they have a chance to control — at the expense of not being able to recognize the root cause of that problem — which is class warfare.

The clash of rich and poor is not a new construct. It has been a constant theme in American history since the Revolution, and was integral to the framing of the Constitution. For the Founders, the “haves and have-nots” were the two most important “factions” that, in the Constitutional order, would check and balance one another so that neither could threaten the freedom of the other. In 1814, John Adams penned a letter that provided an ominous warning, suggesting that the Republic was inherently doomed to fail.

Over the past three decades, the share of household wealth owned by the top 0.1% has increased from 7% to about 22%. At the same time, 90% of families have suffered through a wealth erosion as the result of rising debt, the collapse of the value of their assets during financial crises, and stagnant real wages. These issues represent an ever-widening gap between the “haves” and “have-nots” and represent an extremely fragile fault line that is a major threat to stability as the number of “have-nots” significantly outweigh the number of “haves.”

Jeremy D. Lawhorn poignantly postulated in an article in the Small Wars Journal in 2018 that “Political institutions that exist in the United States emerged so that no single entity was capable of developing and implementing policies unilaterally. This was also the basis for establishing the three branches of government and the development of a multi-party system (albeit currently dominated by two parties). These different branches of government provide checks and balances while the various political parties moderate change as demanded by their constituents. In a perfect system, as these political parties engage in debate on issues relevant to their constituents, solutions should emerge that lead to some form of compromise that is relatively inclusive. This process of civil discourse, debate, and compromise is important and healthy for a free society. In general, it helps build stronger institutions, prevents myopia, and reduces the prevalence of group think, while creating policies that are more representative of the whole of society rather than a few. The history and culture of debate prevalent in America is good until discussions breakdown and people become so entrenched in their positions that they are unwilling to compromise, cooperate, or even acknowledge competing views. This is exactly what happened when the United States descended into Civil War. Both the North and the South were so committed to their positions, they decided that the only resolution was to soak the land with precious American blood.”

These historic lessons of entrenchment remain instructive for Americans today. The difference is that we live in an era in which the speed at which information travels creates a dramatic exacerbation of political polarization. And, as a consequence, the United States might once again find itself at the precipice of self-destruction.

https://researchdesignreview.com/2016/10/13/chaos-problem-solving-in-qualitative-analysis/

Visualizing Wealth Distribution in America (1990-2023)

Share of Total Assets Held by the 1st to 90th Wealth Percentiles, Percent of Aggregate

America's Highest Earners and their Taxes Revealed

Buy, Borrow, Die: How to Get Richer & Avoid Taxes Like Billionaires

https://thehill.com/opinion/civil-rights/514024-america-is-in-a-class-war-not-a-race-war/

https://journal.firsttuesday.us/how-class-warfare-is-hurting-the-real-estate-market/53208/

Ten Ways Billionaires Avoid Taxes on an Epic Scale

How the Wealthiest Avoid Income Tax

How Large Corporations Get Around Paying Tax

Class Warfare is an American Tradition

National Security Implications of Unresolved Grievances

1814 John Adams letter, suggesting that the Republic was ultimately doomed to fail

Excellent work!