Why I Hate Politics - The Student Loan Debate

I know this topic sounds passé, but the battle that is being fought in the media at the moment, related to the subject of student loans is really getting under my skin. If the argument was really about student loans, I guess I'd be more forgiving. But, at its core, this heated debate is completely unrelated to student loans, unless the term "student loans" can be represented as some sort of perverse moniker for politics as usual.

At the center of this discussion is the argument about whether to pass a funding bill that will prevent the interest rate on student loans from doubling on July 1, 2012 from 3.4% to 6.8%. On the surface, one might look at this issue and think "Seems like common sense to me, times are tough and it's good that our politicians in Washington are trying to prevent the interest rate on student loans from dramatically increasing."

It's not that simple, folks. Not by far. Bear with me, we have to go through a little history here first.

Government guaranteed student loans can be traced back to 1965, when the Federal Government created what is now called the Federal Family Education Loan (FFEL) program. The program, and especially the book-keeping associated with how to account for the liabilities associated with loan guarantees has always been a topic of discussion and, more to the point, the reason for numerous legislative tweaks that have been made to the program.

In 2007, Congress passed a law that enacted interest rate reductions for undergraduate subsidized Stafford loans. Stafford loans are government-backed student financing - currently offered at an interest rate of 3.4 percent. The law was phased in over 4 years so that in 2008-2009, the interest reduced from 6.8 to 6.0 percent. It was reduced again to 5.6 percent in 2009-2010 and again in 2011 to 4.5 percent. Finally, in 2011-2012 the interest rate reduced to 3.4%. That law is scheduled to expire this year, which will result in the interest rate doubling to 6.8 percent.

But the real changes started with the widespread credit market disruptions in 2008 and 2009. That economic environment threatened the ability of many private lenders to make loans under the federal guaranteed student loan program, resulting in a discontinuation of the program by numerous private lenders.

In response to the economic turmoil, the U.S. Congress and President George W. Bush enacted a temporary program in May 2008 to allow the U.S. Department of Education to buy guaranteed loans that had been or were being made by private lenders. Under the program, the proceeds from these loans would be used to originate new student loans. The temporary program, the Ensuring Continued Access to Student Loans Act (ECASLA), marked a major historical change in the guaranteed loan program, because it provided federal capital to private lenders making student loans.

In the proposed 2010 fiscal year budget, President Barack Obama requested that Congress proceed with a full elimination of the FFEL program. He argued that subsidies paid to private lenders under the program were unnecessary and that cost savings could be achieved if all federal student loans were made through the direct loan program.

Congress passed and the President signed into law a bill that eliminated the FFEL program for all new loans made as of July 1, 2010. Since then, all federal student loans have been made under the Direct Loan program.

So, now we're back to today. There appears to be, at least on the surface, bi-partisan support for keeping the interest rate low (the current 3.4% level). But let's take a look at the real underlying discussion.

The Democrats are proposing to keep the rates low by raising $5.9 billion through an increase in payroll taxes on S-Corporations. These are typically professional corporations such as doctors, lawyers, accountancy firms, etc with greater than $250,000 in earnings. The Democrat sponsored bill suggests that it will use these funds to subsidize low student loan rates - but there is no requirement in the bill for that to happen. The money could, conceivably, be earmarked for some other purpose.

Our Republican friends on the other side of the aisle, in the mean time, have also proposed to continue the subsidies. But they intend to do it by cutting funding to the healthcare overhaul. Specifically, their bill takes the funding from a $17 billion prevention and public healthcare fund that covers immunizations, research, screenings and wellness checks. They would also completely eliminate Pell Grants for low income students.

Ahhh.... now I get it. It's not about student loans. It's about the Democrats wanting to redistribute the tax base whereby the more affluent Americans would bear a proportionately higher percentage of the tax burden. And, it's about the Republicans wanting to avoid the impact of a government mandated health care initiative that that significantly benefits less-affluent Americans.

Those are your real agendas. Those are the drivers. Student loans are just the cars we're riding in while the drivers -- well -- drive.

OK, so this couldn't be called a blog if I didn't take a position. I'm siding with the Republicans on this one, but not because I agree with their healthcare bill elimination agenda.

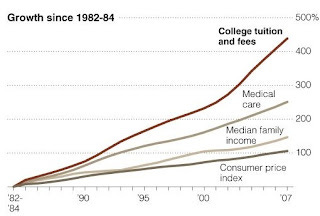

American students are now saddled, on the average, with nearly $30,000 in debts plus interest when they finish their undergraduate programs. Since 1982, the cost of medical care in the United States has gone up over 200%, which is twice the rate of the consumer price index over the same time span. But that pales in comparison with the cost of college tuition which has gone up by more than 400% in the same time period. By subsidizing loans and making them easy for students to obtain, we have artificially created demand for college education, a position which colleges and universities have interpreted as a green light to increase their tuition and other costs. We must consider whether this phenomenon has been influenced by the federal government pushing student loans, and whether the resulting federal student entitlement money has enabled colleges to raise tuition some 25% in the last 3 years.

So, here's my take: We should let interest rates self-regulate in the marketplace. There should be no subsidies. Highly qualified students, rich or poor, will continue to get scholarships. Universities will downsize and consolidate because there will be fewer students and, with lower demand, Universities will find ways to reduce tuition to attract more students. There will be fewer seats and only the most qualified students will get them. Because rates will be higher, marginal students will think twice about taking on more expensive debt to attend college.

And nobody should care what color a student's skin is, what gender they are, or how much money they have. Priority access should be given to citizens of the United States of America. Seats for foreign nationals should be limited and (much) more expensive.

The Republicans should NOT be able to use student loans as a vehicle to push their "destroy national healthcare" agenda. Democrats should NOT be able to use student loans as a vehicle to push their agenda to pass the burden of taxation disproportionately in the direction of affluent citizens.