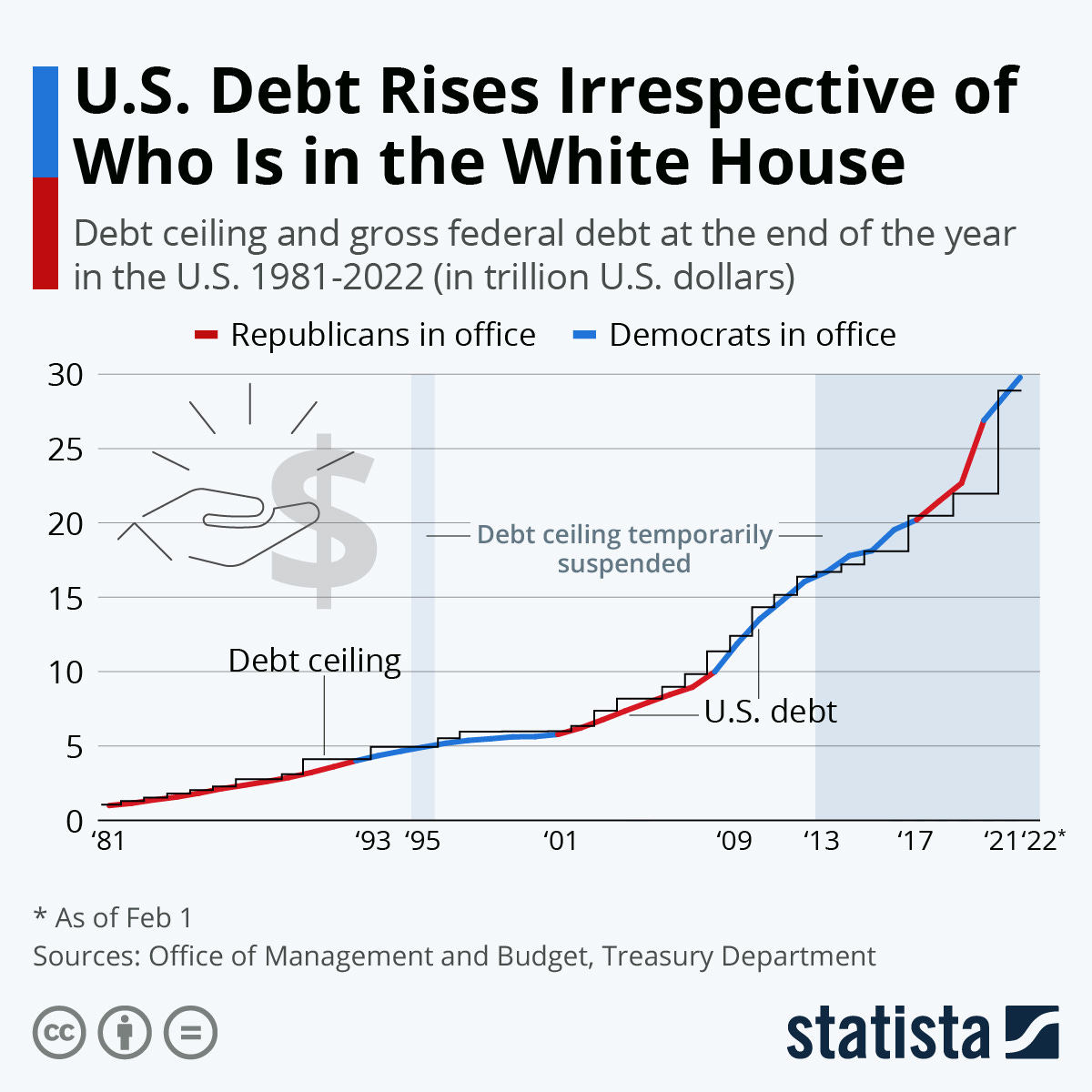

Who Can We Blame for the National Debt Crisis?

Part 1 of 2 on the National Debt: The US Debt limit has increased irrespective of who is in the Whitehouse.

The last time the government spent less than it made was back in 2001 under President Bill Clinton’s budget but Republicans controlled both the House and the Senate.

22.3% of the country’s national debt happened under President Donald Trump [1]. Then president Trump increased the debt by $7 trillion because of the federal COVID-19 relief, which was approved on a bipartisan basis. The Trump era Tax Cuts and Jobs Act is also to blame (passed by Republicans only). During George W. Bush’s presidency, Congress added nearly $6 trillion. Under President Barack Obama in the aftermath of the recession, it grew by $8.6 trillion. So far, the Biden administration has racked up $4.8 trillion of new borrowing.

That said, both Democrats and Republicans have voted to raise the debt ceiling multiple times — in fact, 61 times over the last 40 years! Debt ceiling increases were approved by Congress 18 times under Reagan, eight under Clinton, seven under Bush and five under Obama [2].

The US Debt limit increases irrespective of who is in the Whitehouse [3].

Moreover, according to the Treasury Department: "The debt limit does not authorize new spending commitments. Those obligations are the result of laws previously enacted by Congress. It simply allows the government to finance existing legal obligations that Congresses and presidents of both parties have made in the past.

The Treasury currently estimates that those measures will be sufficient at least through early June. Sometime after that, unless Congress raises or suspends the debt limit before June, the federal government will lack the cash to pay all its obligations [4].

Failing to increase the debt limit would have catastrophic economic consequences. It would cause the government to default on its legal obligations – an unprecedented event in American history. That would precipitate another financial crisis and threaten the jobs and savings of everyday Americans – putting the United States right back in a deep economic hole, just as the country is recovering from the recent recession. Even in a best-case scenario where the impasse is short-lived, the economy is likely to suffer sustained—and completely avoidable—damage.

There is quite a bit of historical precedent to rely upon to gauge what might happen in the event of a debt default. In October 2013, the Federal Reserve simulated the effects of a binding debt ceiling that lasted one month—from mid-October to mid-November 2013—during which time Treasury would continue to make all interest payments. The Fed economists estimated that such an impasse would lead to an 80 basis point increase in 10-year Treasury yields, a 30% decline in stock prices, a 10% drop in the value of the dollar, and a hit to household and business confidence, with these effects waning over a two-year period. According to their analysis, this deterioration in financial conditions would result in a two-quarter recession, leading to an increase in the unemployment rate of 1.25 percentage points and 1.7 percentage points over the following two years. Such an increase in the unemployment rate today would mean the loss of 2 million jobs in 2022 and 2.7 million jobs in 2023.

Congress has always acted when called upon to raise the debt limit. Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents. Congressional leaders in both parties have recognized that this is necessary." [5]

The Bottom Line: If Congress allows the debt limit to bind, the impact, both short- and long-term on our economy could be severe -- even if we assume that principal and interest payments continue to be made. And if the Treasury fails to fully make all those principal and interest payments—because of political or legal constraints, unexpected cash shortfalls, or a failed auction of new Treasury securities—the consequences would be even more dire. If the debt ceiling binds, and the U.S. Treasury does not have the ability to pay its obligations, the negative economic effects would quickly mount and risk triggering a deep recession. [6]

The Treasury Department is currently operating under constitutionally enabled "Extraordinary Measures":

But what happens if this impasse is not taken care of quickly?

Financial markets, businesses, and households would become more pessimistic about a quick resolution and increasingly worried that a recession was inevitable. More and more people would feel economic pain because of delayed payments. Take just a few examples: Social Security beneficiaries seeing delays in their payments could face trouble with expenses such as rent and utilities; federal, state, and local agencies might see delays in payments that interrupt their work; federal contractors and employees would face uncertainty about how long their payments would be delayed. Those and other disruptions would have enormous economic and health consequences over time. Given that those disruptions would likely occur when the economy is growing slowly and perhaps contracting, the risk that the crisis would quickly trigger a deep recession is heightened. [7]

Keeping in mind that increasing the debt ceiling is about allowing the US Government to make payments on existing commitments and not about new funding initiatives, it becomes clear that this is purely about political gamesmanship. Instead of playing political games over the debt limit, Congress should be taking up measures that would require a balanced budget.

[1] https://www.newsweek.com/trump-national-us-debt-1774764

[2] https://komonews.com/news/nation-world/whos-to-blame-for-the-debt-ceiling-dilemma-debt-limit-treasury-department-debt-ceiling-tea-party-kevin-mccarthy-speaker-of-the-house-president-joe-biden-entitlements-credit-rating-janet-yellen-africa-taxes-spending-funding

[3] https://www.statista.com/chart/1505/americas-debt-ceiling-dilemma/

[4] https://www.brookings.edu/2023/01/25/how-worried-should-we-be-if-the-debt-ceiling-isnt-lifted/

[5] https://home.treasury.gov/policy-issues/financial-markets-financial-institutions-and-fiscal-service/debt-limit

[6] https://home.treasury.gov/system/files/136/Description_Extraordinary_Measures-2023_01_19.pdf

[7] https://www.wsj.com/articles/what-is-pushing-the-national-debt-to-its-limit-e93a1e69

[8] https://www.cnn.com/2023/02/15/politics/debt-ceiling-default-cbo-congress/index.html